If you win money with lottery scratchers, make sure you can keep as much of your earnings as possible. The Internal Revenue Service (IRS) allows you to claim gambling losses as a deduction on your tax return. And any losing tickets prove that you had losses to claim. So keep those losers in an envelope for April 15!

The federal tax withheld from earnings is 24% for winnings of $5,000 or more. (If you’re a foreign national, the tax is 30%). But how much did you lose before you won that money for yourself? You can claim losses only up to the amount of your winnings, but that also means you reduce your overall taxable income.

Did you win less than $5,000? Great! You don’t automatically lose 24% of it to the federal government. Yet you still get to claim your losses up to the amount you won! On a $1,000 scratcher prize, you’ll pay the 4% Virginia state tax but keep the rest. And everyone complains the IRS does nothing for them.

If you won over $600, note that your winnings were reported to the IRS and 24% has been withheld just in case you don’t provide your identify info. That’s why Virginia Lottery requires that you claim prizes of $601 or more by mail or in person rather than get a cash payment from a retailer. When redeeming in person must provide valid government-issued photo ID and your Social Security card or other proof of your Social Security number.

Claiming the Deduction for Losses

You should receive a Form W-2G issued to you by the retailer for any scratcher winnings over $600 and the winnings amount to at least 300 times the scratcher cost (i.e., the original wager). The Form W-2G will show the taxes already withheld from the winnings. Claiming your losses requires that you:

- Report all gambling winnings as “Other Income” on Form 1040 or Form 1040-SR (use Schedule 1 (Form 1040) PDF), including winnings that aren’t reported on a Form W-2G .

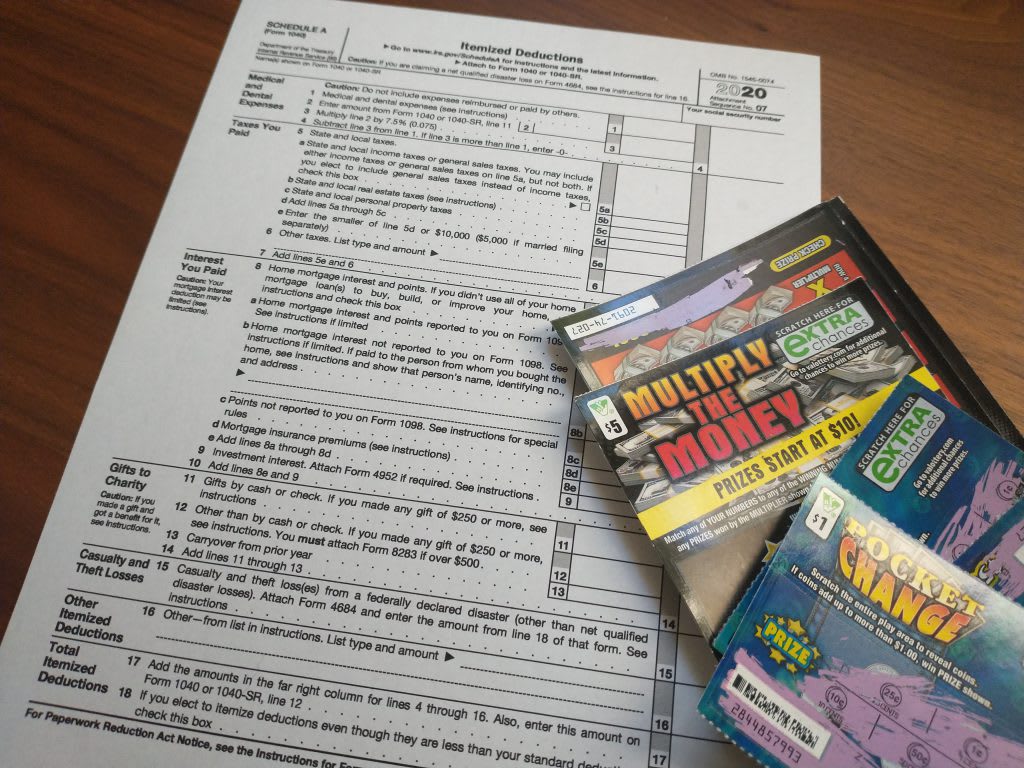

- Itemize your deductions on Schedule A (Form 1040).

- Keep an accurate diary or similar record of your gambling winnings and losses.

- Be able to provide receipts, tickets, statements, or other records that show the amount of both your winnings and losses.

Records of Your Scratchers

For #3, note that the IRS states, “Your diary should contain at least the following information.

- The date and type of your specific wager or wagering activity.

- The name and address or location of the gambling establishment.

- The names of other persons present with you at the gambling establishment.

- The amount(s) you won or lost.”

Seems ripe for one of my favorite tools: the spreadsheet! The IRS also notes: “You must report the full amount of your winnings as income and claim your losses (up to the amount of winnings) as an itemized deduction. Therefore, your records should show your winnings separately from your losses.”

Keep All Your Losers

For #4, remember that:

- All scratchers are required to be paid in cash, and

- Any scratched-off scratcher is proof of a gambling loss.

Even those losing tickets with the eXTRA Chances logo show proof of gambling losses. As the IRS states, “Supplemental records include unredeemed tickets, . . .” So hold onto those for your records come tax time!

For you, readers, I wish all your winnings exceed the losses you claim.

Note: I am not a tax expert, and nothing written above should constitute professional tax advice. Refer to the sources for the original info and/or consult an actual tax expert for guidance on gambling winnings/losses.

Sources:

- IRS – Topic No. 419 Gambling Income and Losses: https://www.irs.gov/taxtopics/tc419

- IRS – Instructions for Forms W-2G and 5754 (Rev. January 2021): https://www.irs.gov/pub/irs-pdf/iw2g.pdf

- IRS – How Do I Claim My Gambling Winnings and/or Losses?: https://www.irs.gov/help/ita/how-do-i-claim-my-gambling-winnings-andor-losses

- IRS – About Form W-2 G, Certain Gambling Winnings: https://www.irs.gov/forms-pubs/about-form-w-2-g

- IRS – Publication 529 (12/2020), Miscellaneous Deductions: https://www.irs.gov/publications/p529#en_US_202012_publink10004013

- Virginia Lottery – Retailer Manual: https://www.valottery.com/-/media/Images/Retailer-Center/Virginia-Lottery-Retailer-ManualFINAL1026.ashx?la=en&hash=BB5D3BD5CF84FB74BC458DE1E398F17C8F870C82

- Virginia Lottery – website: https://www.valottery.com/winnersnews/claimprize